“ Life is a cycle of ends and starts”

Mark Webber

Insurance is taking some type of protection against financial loss. It is a very important part of wealth creation. Insurance minimizes losses that can easily cripple us financially. Insurance serves as the base for the secure phase of wealth creation and growth. It is an important part of a financial plan. Insurance should not be confused with savings and investment, because it is more of a safety net and does not increase wealth, it just safeguards it.

Insurance companies come into existence when like-minded people pool their funds together the possibility of risks occurring is then assessed and measured. Of course, there are regulations around who can offer Insurance services and what the services entail. In Kenya, the Insurance industry is regulated by the Insurance Regulatory Authority.

So why is insurance important?

1. The most obvious reason would be the compensation in case of an event of a loss. Under a contract of insurance, the loss event will have been defined in advance and so will the amount that has been insured. The premium payable to the insurance is usually a minimal amount compared to the compensation one gets. This is because of the principle of pooled resources.

2. Most Insurance will take you back to the financial position you were in before the loss. Sometimes one can’t be fully brought back to where you were e.g. in the case of the loss of life. However, with the compensation, it means that despite the loss occurring, you can pick up and continue with life, on a good financial footing.

3. Insuring yourself and your property gives you peace of mind. It allows you to continue in your wealth creation journey with the knowledge that your assets are secure against loss. There is a lot of comfort in knowing that the assets you are creating, can be replaced in case of damage or total loss.

4. Self- Insurance is very expensive. You can imagine if for every asset you own you had to keep aside the same amount of money in the event of a loss. That would most likely be an exercise in futility.

We would be very poor managers of our resources if we did this. Other than an emergency fund which is some form of self-insurance I would not recommend any other kind of self-insurance.

There are various reasons why we should take insurance.

a) It is required under the Kenyan Law:

i) National Health Insurance Fund (NHIF);

In Kenya, individuals are required to take up the National Health Insurance fund for health insurance. This is for both employees as well as self-employed individuals. The insurance is then used to access health services in designated hospitals and health facilities.

iI) Workman’s Compensation covered under the Work Injury Benefits Act (WIBA);

This insurance is required by employers, provided the employer has at least one employee. It insures employees against injury while carrying out their duty. It covers the employees and compensates them for injuries that lead to temporal, partial, or total disability and includes death.

iII) Third Party Motor Insurance;

This insurance is required for car owners. It covers the other party and their vehicle in the event of an accident, hence the name third party.

b) It may be required to offer professional services and run a business effectively:

i) Professional indemnity:

This is important for professionals who offer services to the general public. It is possible that while dispensing professional advice you may be sued. Professional indemnity though considered expensive is very important so that such an event does not set you back several years.

iI) To secure Business Assets:

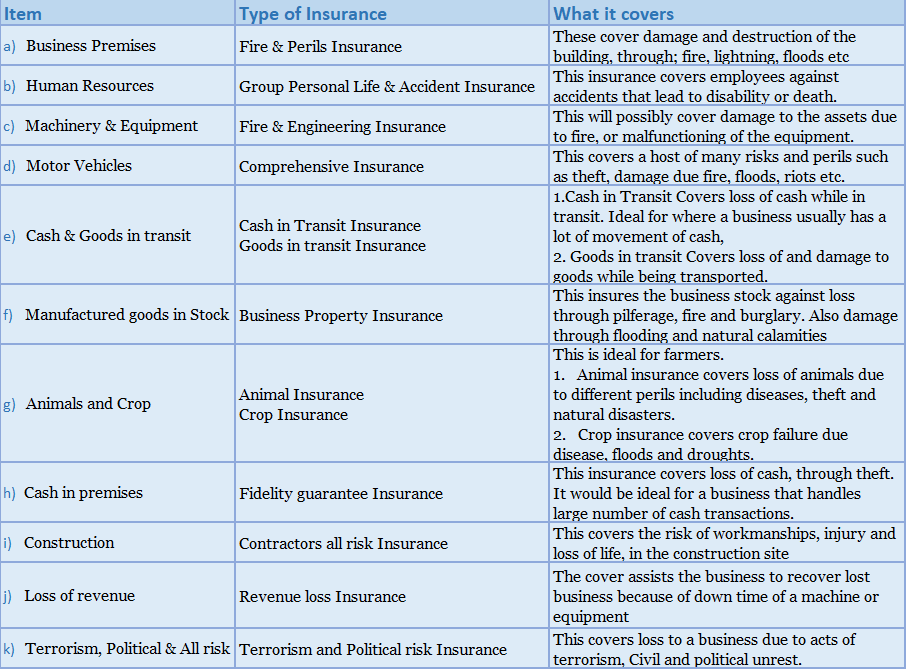

Business assets and the type of insurance that can be taken are quite far-ranging.

Some examples of insurance that a business should take are listed in table below:

Obviously, the above table is not exhaustive and can only serve as a guide as to what insurance can fit your particular business circumstances.

c) It is required by lenders;

Whereas a business or as an individual you purchase an asset through asset financing, the lender will insist on having insurance on the asset.

Mortgage Protection Insurance in the case of real estate or ;Comprehensive insurance, in the case of vehicles.These insurances will usually include the lender as a beneficiary, in the event of a loss.

d) We take out personal insurance for our peace of mind;

i) Life Insurance:

This insurance is important especially if you have dependents. The people who stand to lose financially from your absence. Get term life insurance, especially where you have younger dependents. As a bonus, it is much cheaper. Whole life insurance while also good, has a savings component to it, which is not necessary. The return on that saving is usually much lower than your average saving accounts. Life insurance has tax planning advantages.

iI) Health Insurance;

We live in uncertain times as far as our health is concerned. It is important to get extra health insurance to complement NHIF. When purchasing health insurance, consider the whole package; exclusions, waiting periods, and the listing of pre-existing conditions. Health Insurance is especially critical when you are planning for retirement, as medical expenses at that time are usually quite high. It is vital to make it part of a budget

iII) Domestic Insurance:

This insurance is important for your household goods. It covers loss due to various perils such as theft, fire, flooding, among others. It also covers your domestic workers in case of injury to them.

iV) All comprehensive risk cover;

This insurance covers items like mobile phones, laptops.

v) Travel insurance;

If you have travel frequently outside of your country, then you know how travel insurance is important. It will usually cover loss of luggage, medical emergencies, and evacuations. Most travel agents usually provide it as part of travel packages.

Insurance is very important and it gives a base on which wealth can be built and accumulated.

While I have tried to give as many examples and types of insurance, these are just but a few.

The best time to take out insurance is before you need it. This means at the earliest opportunity please purchase it might just save you from disastrous events.

It is also important to enquire whether an insurance package has additional riders that you would be interested in. To understand and purchase insurance, engage your licensed insurance agent. They will usually help you to get the insurance packages that best fit your lifestyle and pocket, of course!