“ Life is a cycle of ends and starts”

Mark Webber

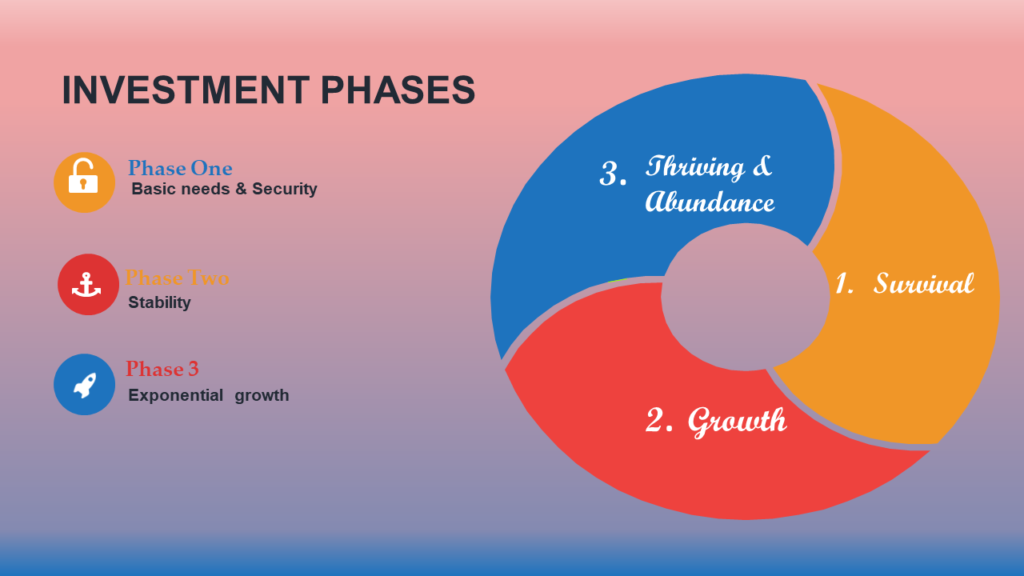

Personal finance experts tell us that there are certain investment milestones we need to achieve at various phases of our lives for us to eventually enjoy financial freedom. If we get it right, in every decade from our 20s to our 80s and 90s, we will build and secure our finances and investment towards ultimate wealth!

The road to getting and growing wealth is a journey that is intentional. Every day we work at pushing the needle towards building this wealth. We travel from fulfilling our most basic human needs to self-actualization.

Each phase is a foundation for the next part of the investment journey.

Phase One; The survival phase

When we branch out as newly independent adults, the first phase is making sure we survive and are secure; this means we take care of our most basic needs. Food, shelter, clothing, health, and education. Our income can take care of these basics in life.

Most of us will usually accomplish this through salaried employment, self-employment, and owning a small or medium enterprise.

This is the typical starting out phase for those in their 20s, whose biggest resource in this journey is time, even though money may be a bit tight.

Some of the things you should be doing in this phase include living below your means, start building an emergency fund and start investing for retirement. The retirement fund is especially vital because you will enjoy the benefit of compound interest over a long period of time.

Phase Two; The growth phase

In this phase, we have some substantial extra income left over after we have taken care of our basic needs. This phase may go concurrently with the first phase although the extra disposable income grows as one gets promotions and pay increases.

Here, we invest the surplus income for our various goals ranging from short-term goals saving and investing for a wedding, an upcoming vacation; to long-term goals such as a down payment on a house, building a retirement fund, an education fund for our children. The investment vehicles will also be diverse ranging from money market funds, treasury bills, and bonds to shares and mutual funds.

This phase is where most of us stagnate. I definitely, struggle here from time to time. We get caught up in keeping up with the bills. Worse still, if we are not careful, we can easily be submerged in debt in this phase of our lives as too many “needs” are chasing after limited income.

The typical group in this phase is the 30s to mid-40s

To shore ourselves in this phase we should be buffering up the funds we started in the first phase, and start funds for mortgage down payments, education funds. In this phase, we should also start investing surplus, in mutual funds, directly in the stock market, in real estate as well as other investment vehicles.

As much as possible find ways to pay down debt quickly.

Phase Three; The thrive & abundance phase

This is the phase of self-actualization, reaching financial independence. Here, we intentionally navigate through the second phase and increase our ability to grow wealth. This is achieved through starting or expanding our existing businesses and increasing our sources of income, mostly passive income.

To reach this phase we have to be deliberate with our investments to achieve exponential growth. Aggressive but well thought out investments will catapult us towards financial freedom. The calculated risks we take should lead to a compounding of our investment value, over time.

The starting age group for this phase will usually be the 40s to mid-50s.

Here, the typical members of this phase will have paid off their mortgages, fully funded their children’s education funds, and operating with little- to- no personal debt. The investment vehicles used in this phase include stocks, mutual funds, real estate, private equity, and businesses.

This is also the phase of philanthropy and gives of oneself and resources back to society as you have more and surplus from your investments.

All said and done, if you are not in the place you wish to be please remember, mine is just a guide which is meant to help us reach our aspirations. You and I may not be where we want to be today, but if we keep making intentional steps towards our goals we will eventually reach where we want to be, of that, I am convinced.

To help us along this journey I have made a summary printable for each of the phases. The free printable is a checklist for each of the three phases. Please go ahead and sign up so you can access your free copy.

Always remember, you’ve got this.

See you at the top!