“You may delay, but time will not. “

Benjamin Franklin

I am currently reading a book, Franklin’s Thrift by three co-authors David Blankenhorn, Barbara Dafoe Whitehead, and Sorcha Brophy – Warren. One of the themes the book covers is the genesis of Savings and Mutual banks better known to us today, as Savings and Credit Cooperative Societies (SACCOs).

The book setting is in the 17th and 18th Century where immigrants from Europe were streaming into the Americas and starting their new way of life independent of the Aristocracies that they had left behind. In Europe, there were very few ways you could become financially free. You were either born into a rich family or got an inheritance from a rich relative. In a few instances, you could marry your way into wealthy families.

The theme of the book is anchored in the American dream and how it fueled the growth of Savings and Mutual banks.

The American dream which if I can loosely interpret, speaks to ones’ entrepreneurial spirit being the catalyst of financial freedom.

The dream asserts that all men are equal and what determines whether you will make wealth or not is the effort you put to achieve financial freedom.

One of the ways the people use to accelerate their financial independence was putting their savings in Savings and Mutual banks.

The Savings and Mutual banks drew membership from the masses who were eager to put in their modest savings. With the savings, the banks could then lend to their members. This is the same model that SACCOs use today.

The book is an interesting read please pick it up as I have found myself agreeing with some of Benjamin Franklin’s Maxims of wealth building.

Why SACCOs?

I am a proponent of saving in SACCOs. I have been a member of one since I started earning a salary and it has served me well.

However, I have asked some of my friends to join one as an investment avenue, and they have probably looked at me as though I had grown a second head. Away from comedy, the experiences some of them have had and the reports on media are not encouraging at all. In fact, it can probably be deemed as one of the fastest ways to lose your hard-earned money, through outright plunder and mismanagement of the institutions.

I have a friend who is currently paying off a loan where he was one of the guarantors, for a colleague. The colleague later left the organization they worked together in and promptly stopped servicing the loan.

So, while I advocate for saving in SACCOs I appreciate those who hesitate because they have had their fingers “burnt” in the past.

Some of the benefits of joining a SACCO include;

1. It helps you create a culture of saving;

To remain a member in good standing, you must save regularly, usually monthly. As an investor, this is a good discipline to have, because you must include in your budget the SACCO contribution. Most SACCOs will have a minimum amount that should be deposited.

2. Interest and Dividend income from deposits and shares;

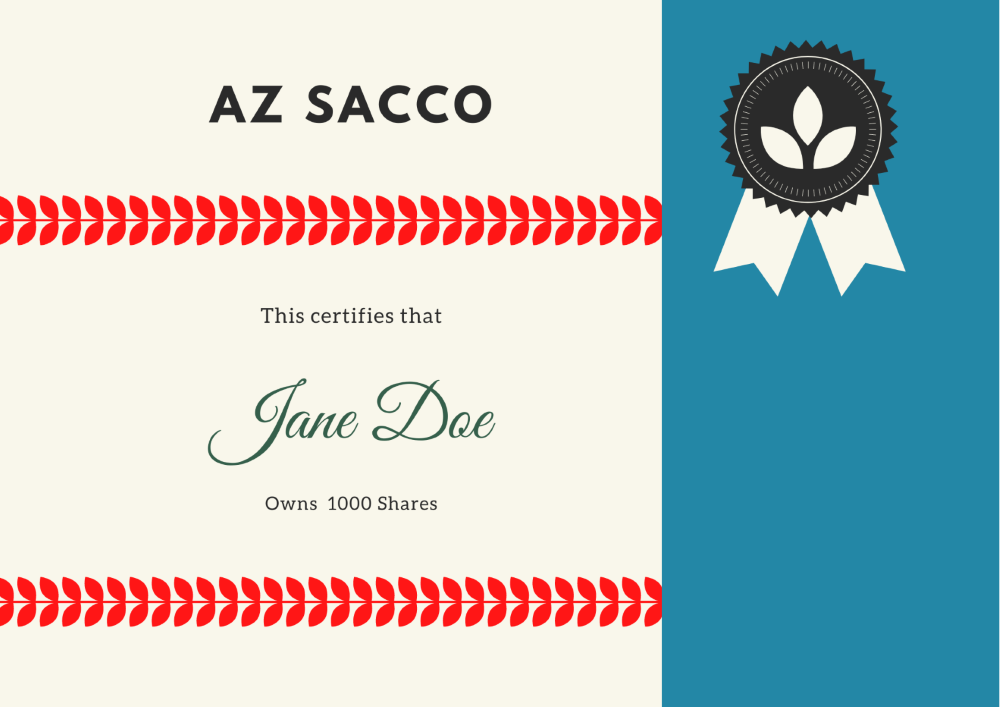

Presently, SACCOs require members to contribute towards shares that form the core capital of the society and deposits which form the basis of members’ borrowing. Both contributions earn a return to the investor.

The deposits, earn an interest income. They are also refundable when a member exits from the Society. Shares, earn dividend income and are usually transferrable to other members. In most Saccos, the dividend rate is usually slightly higher than the interest rate. Both returns are subject to tax.

This kind of investment is good especially when you are in retirement and need a consistent source of income.

3. Borrowing using your deposits as security;

As a member of a SACCO, you are allowed to borrow, using your deposits as security. SACCOs allow members to borrow 3x or even more of their deposits provided they have guarantors. The guarantors will step in to pay the loan if the borrower defaults in repaying the loan. Usually, guarantors are SACCO members who know the borrower well.

When this model is used well, it boosts members’ ability to grow themselves fast because they are not limited to borrow the equivalent of their deposits only.

4. Predictable borrowing interest rates;

I have been a member of a SACCO for about 15years. In that time, the borrowing rate has been a steady 12% per annum for a development loan. If you have borrowed from the banks in those years, you may have been subjected to fluctuating interest. There is peace of mind in knowing that from the start to the end of the loan tenor, the interest rate will remain constant.

How do SACCOs work?

The SACCO movement in its purest form is intended to uplift the economic well-being of its members.

This is through regular contributions, usually monthly deposits from which, members can borrow to develop themselves and acquire assets.

There is also a one-off, purchase of shares by a new member. This goes into the core capital of the SACCO. Shares are usually transferrable but non-refundable.

The monthly deposit is put in the members’ account from which they will earn an interest and the same deposits can be used as security against loans the member takes.

Unlike mainstream banks, their risk appetite is quite low as far as investing the member funds is concerned. Their major source of revenue is interest paid from members’ borrowings.

How to invest

The ‘magic’ of a SACCO, for me, is in the discipline of saving. While in ordinary banking arrangement you can put a lump sum amount in your savings account, once a year and be on your merry way, it is not the same for SACCOs.

To remain a member in good standing, you need to put in a minimum amount monthly, usually about Kshs.1K towards your deposits. This is essential if you are keen on building a good track record, to access a loan in the future.

This culture is important because of building trust but also because member deposits are the main source of the Societies’ cash inflows.

For an individual saver, as you grow your deposits you will benefit from compound interest. This is because every month there is an amount that is adding to the deposits and as a consequence your interest income.

The interest and dividend income are declared at the end of each financial year. This is key, especially for members who join the SACCOs purely for the saving culture and the returns.

In this investment, patience and consistency are key, big results are seen when you put away a little amount. consistently.

Although SACCOs are commercial entities, they are guided by social aspects:

i) To be responsible for and safeguard Members’ deposits

ii) To give a modest return to its members and,

iii) Uplift the economic well-being of its members.

How to choose a SACCO to invest in

When I was looking for a SACCO to join, I researched three, looking at their track records. Some of the aspects I was looking for were;

1.Who is in its management team?

I wanted to satisfy myself they had experience in SACCO matters. A well-balanced team gives confidence that the members’ monies are in safe hands.

2.What kind of financial results have they returned over time?

I checked for erratic reported results, for my comfort I needed predictability in the results, no sharp movements, please!

It is vital to avoid chasing after extraordinary returns without putting in time and effort. You will then, not get into the problem of investing with institutions that promise “high returns” with no evidence of how these results will be achieved.

3.How Are their corporate governance structures?

A substantive and competent board in place was important to me. Are the board members seasoned? Checks and balances are key so that the management is steered in the right direction.

4.How did they relate with the regulatory body?

Here, I was checking whether they were fully licensed year on year or if they were given conditional and periodic licenses for non-compliance. Conditional or periodic licenses were a red flag for me.

In Kenya, SACCOs are regulated by the Sacco Societies Regulatory Authority (SASRA) which issues operating licenses and provides general oversight.

5. Lastly, I Talked to members of the SACCOs.

I wanted to know their experiences with the institutions. I pored over every bit of information that was available . It was hard work but well worth it.

There are a few solid SACCOs that have stood the test of time, and it is important to identify which ones so that you are comfortable with where you put your money.

Saving in a SACCO for me is a basic tenet of wealth accumulation. It is part of putting up the foundation that will propel you from financial insecurity towards financial freedom.

Even in this knowledge age, I submit to you this principle of wealth creation has stood the test of time.

Just as it was for the immigrants setting foot in the Americas for the first time, armed with nothing much but a dream; that if they worked hard, lived modestly, and saved regularly with time they would be financially free. They were determined to achieve this, and Benjamin Franklin was proof that they could.