“The hardest thing in the world to understand is the income tax”

Albert Einstein

Let’s talk taxes! Most of us dread taxes and everything to do with compliance, sometimes from a position of lack of knowledge of the tax laws and how they operate. While we may want to bury our heads in the sand as far as taxes are concerned, ignorance of the tax laws is no defense and at its worse non-compliance can easily bankrupt you.

From the onset, let me start with a disclaimer that this blog does not constitute professional tax advice rather this is purely my opinion. For tax advice please engage the services of a tax expert who is duly registered by Institute of Certified Public Accountants of Kenya (ICPAK) and accredited by the Kenya Revenue Authority (KRA).

I had a chat with a good friend of mine recently about some of the struggles the Small & Medium Sized Enterprise (SMEs) face in complying with the tax regime. Good thing is she knows quite a bit about tax compliance, and she contributed a lot in shaping this conversation today.

There are various types of taxes that you will need to comply with if in you are in business. I’ll be making an introduction of some taxes that a typical SME deal with. We will get into more detail and even discuss other categories of taxpayers in subsequent blogs.

So ,what are some of the taxes you should have in your line of sight, as an SME at a bare minimum?

Turnover Tax

Well, under the Finance Bill 2019, Turnover tax was reintroduced and comes into effect 2nd October 2019.It will be levied at the rate of 3% of the gross turnover, for Small & Medium Sized Enterprises with the exception of persons involved in management and professional services, rental properties or incorporated companies. This is applicable for SMEs expected to earn less than KShs 5 million per annum and more than KShs 500,000.

In lay man’s terms it is a tax on Sales, also known as Turnover. It is a final tax meaning that if you choose it then the 3% on total sales is what you’ll pay on your business income.

Pay as you earn (PAYE)

The Income Tax Act provides that a person who is an employer shall account for tax on income earned by employees at the graduated scales and remit the same to Kenya Revenue Authority (KRA) by the 9th day of the month following the deduction of the same.

Where an employer has given an incentive to their employees in the form of pension contribution to a registered pension scheme, then both the employer and employee’s contribution (combined) enjoy a tax deduction of up to KShs 20,000 per month.

Value Added Tax (VAT)

If your business is obviously disqualified from the turnover tax i.e. where you are involved in management and professional services, rental properties or you are an incorporated company or your sales are not within the prescribed threshold, then you will have to register your business for Value Added Tax under the VAT Act, which imposes VAT on taxable supplies at the rate of 16%. The taxable supplies include the taxable goods and taxable services as prescribed in the Act.

The taxable supplies purchased for the purpose of business are claimable as input VAT and this is subject to restrictions such as the invoices of more than 6 months, car hire service invoices, purchase or repair of private motor vehicles, restaurant & catering services just to mention a few of the exceptions.

This simply means that you net off the output VAT you pass to your customers against the input VAT that you pay when you purchase your business supplies.

In order to comply with the law, you will need to obtain an Electronic Tax Register (ETR) or an Electronic Signature Device (ESD) machine which you will use to issue tax invoices.

Corporation Tax

Still under the Income Tax act ,Corporation tax is a direct tax on the profits of the business. Currently the tax rate is 30%.

Withholding Tax

As an enterprise you will be required by law to withhold tax when making payment to your creditors. The Income Tax Act provides that a person shall withhold tax at prescribed rates upon making a payment to either a resident or a non-resident person in respect of certain payments such as management or professional fees.

The Act defines management or professional fee as “a payment made to a person, other than a payment made to an employee by his employer, as consideration for managerial, technical, agency, contractual, professional or consultancy services however calculated”

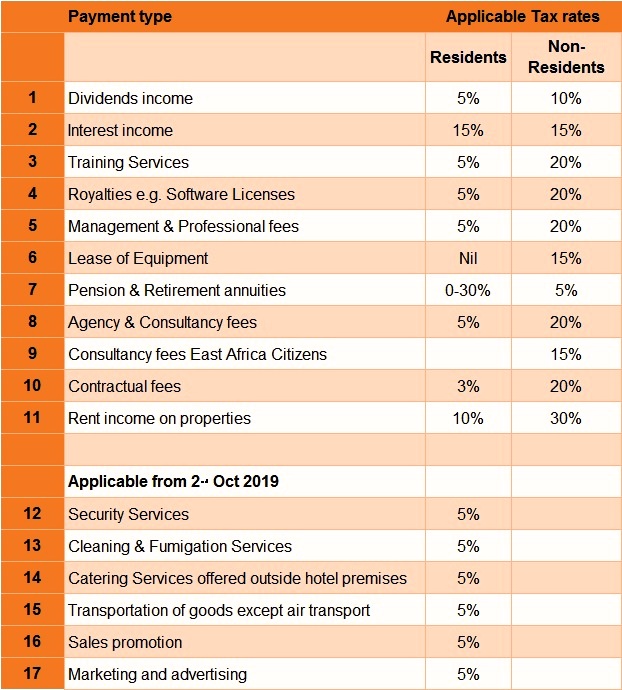

The rate at which the tax is withheld depends on whether the person you are paying is a resident or a non-resident with a permanent establishment in Kenya. It’s important to be clear on this. See below some examples of the current applicable tax rates

Withholding tax is an advance tax on the payee which means it can be reduced subsequently from the total income tax due, as a tax already paid.

Important note: There are countries with which KEnya has double tax treaties for the purpose of easing the tax burden of the taxpayer. Be sure to confirm the applicable non-rates for such countries.

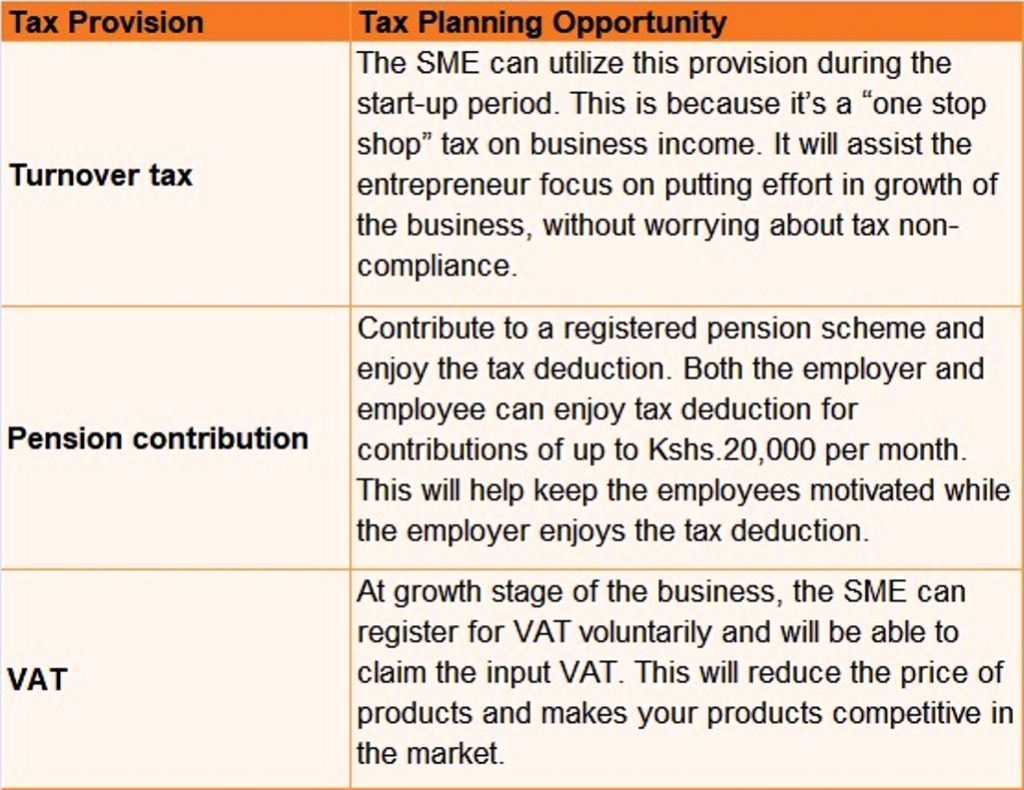

In conclusion, i have summarized what i believe would be some tax planning opportunities for an SME.

Ideally you should pick the tax planning opportunity that works best for your circumstances.

So, as an SME what is your tax story?

Well written!

Thank you Nicoletta!